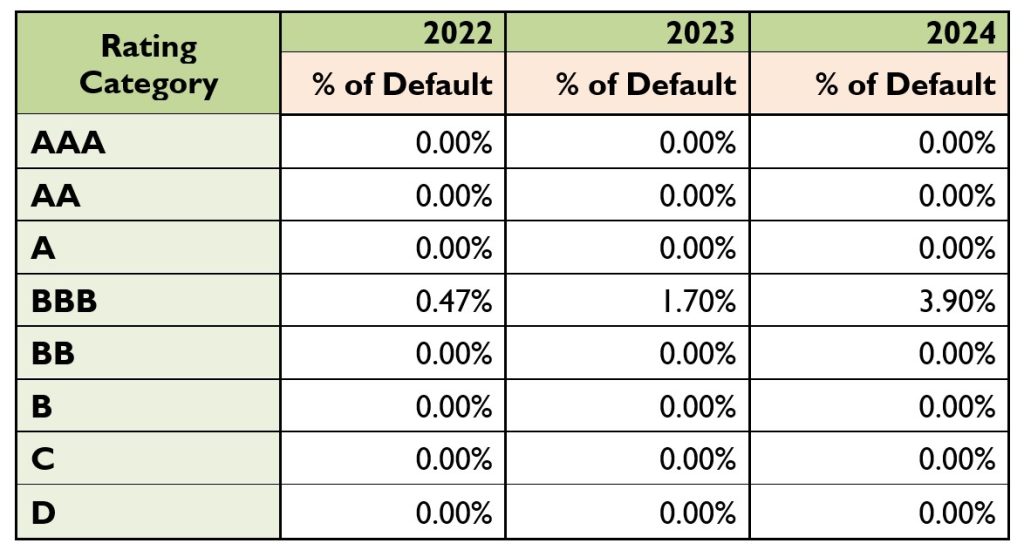

Default Rate Corporate 2022, 2023, and 2024:

WCRCL’s default rate carried out to see whether any rated entity has defaulted in particular period i.e. has gone down to the level of BB or lower rating category.

Above table indicates that, in 2022 no default at AAA to A rating notch, and default rate at BBB at 0.47% (1 entity downgrade to from BBB to BB of 239 entities). In 2023, no default at AAA to A rating notch, and default rate at BBB at 1.70% (4 entities downgrade to from BBB to BB of 240 entities). In 2024, no default at AAA to A rating notch, and default rate at BBB at 3.90% (8 entities downgrade to from BBB to BB of 205 entities).

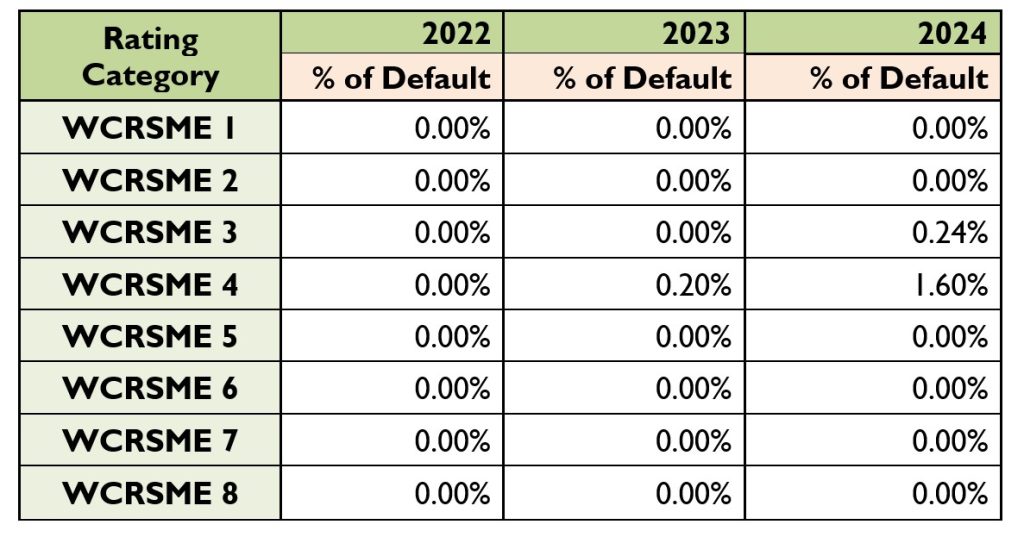

Default Rate SME 2022, 2023, and 2024:

WCRCL’s default rate carried out to see whether any rated entity has defaulted in particular period i.e. has gone down to the level of WCRSME 5 or lower rating category.

Above table indicates that, in 2022 no default at WCRSME 1 to WCRSME 8 rating notch. In 2023, no default at WCRSME 1 to WCRSME 3 rating notch, and default rate at WCRSME 4 at 0.20% (1 entity downgrade to from WCRSME 4 to WCRSME 5 of 518 entities). In 2024, no default at WCRSME 1 to WCRSME 2 rating notch. Default rate at WCRSME 3 at 0.24% (12 entities downgrade to from WCRSME 3 to WCRSME 5 of 4924 entities), and default rate at WCRSME 4 at 1.60% (4 entities downgrade to from WCRSME 4 to WCRSME 5 of 249 entities).